Success Stories

Same Budget, More Impact: How One Credit Union Reallocated a Marketing Budget for Stronger Results

By Donna Adinolfe

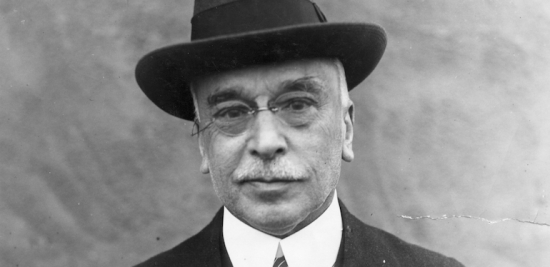

When Armand Parvazi joined New Orleans Firemen’s Federal Credit Union as the new chief administrative and development officer, he took a look at the marketing and business development budget and immediately saw the challenge: Too many small-dollar sponsorships and donations the credit union was making were taking up a good portion of the budget. The result? There wasn’t much room left for marketing and business development.

“It’s in our heart to donate to good causes,” Parvazi said. “We’d hear about a sponsorship opportunity and think, OK, it’s $250, let’s do it. But little things add up, and too much of our budget was going to sponsorships that didn’t give us much impact.”

Parvazi then asked a simple question. How do we increase engagement and have the greatest impact on our communities?

The reality is that today’s members have many options. “We want to provide our members with a better product while being there for them,” Parvazi says. “Our business development team is awesome. We just needed to find inefficiencies and help improve their impact.”

While almost every credit union talks about needing a bigger marketing budget, Parvazi took a fresh approach: How can funds be otherwise allocated to get powerful results while keeping within the same total budget?

What they did: The next step was an examination of how the budget was being used. The vast majority was going to business development, leaving almost nothing for marketing. The credit union also looked at how spending was being tracked, which budgetary items were ineffective and which products had the greatest impact on members’ financial health.

Parvazi sat down with the senior development officer, Kym Copeland, and came up with a novel idea: What would happen if each business development rep was given a $500 monthly budget to use as they saw fit in their own location? Because reps best know the needs of their members, the idea was based on sound reasoning. New Orleans Firemen’s Federal Credit Union covers seven geographic markets with nine branches, making for diversity in a member base that the local employees know best.

Each rep was allowed $200 per month for interaction (lunches, meetings, etc.) with clients and $300 monthly for sponsorships and donations. The reps were then challenged to look at their areas and create specific goals. Each team came up with a wish list, noting why their recommendations were worthwhile in their areas.

Empowering the staff that’s actually in the local area with an opportunity to allocate funds is a great idea, but the transition wasn’t smooth. At first, employees were asked to write up a wish list for business development, but they came up with the same budget they had before. Rather than telling them what to cut, the credit union gave them a set amount and instructions to allocate it as they saw fit. This brought business development expenses from six figures down to half of that, allowing for the team to focus on strategies that had greater impact and fit marketing activities.

Results: At first, the reps were hesitant because they had never been responsible for making sponsorship decisions or deciding how to allocate a budget. “It took a couple of months for them to feel like they could speak up,” Parvazi said. “There was a feeling of being set up to fail because of all the freedom they now had, and some reps felt it was too good to be true.”

“The revamped budgeting process,” Parvazi added, “not only made the business development reps more of a champion in their individual areas, but it also created stronger relationships between them and our branch managers.”

The marketing and business development budget was restructured, allowing for greater outreach to existing and potential members.

Practically speaking, reps can rollover funds to the following months and they can dip into next month’s budget as long as they are accomplishing goals.

The savings in the budget allowed New Orleans Firemen’s Federal Credit Union to implement an MCIF system to target its membership for relevant messaging, drastically reducing production costs and resulting in a higher ROI, Parvazi said.

The credit union continues to study what needs to be measured, how to target members and which members to target.

Key Lessons Learned:

The overall marketing/business development strategy needs to be defined. It may sound simple, but it’s imperative that there are markers for success. Until success is defined, no one can really know what is expected.

Question everything. Just because something was “always done that way,” it does not mean it makes sense or that it should continue to be done that way. In many cases, seemingly significant items can be taken out of the marketing budget without member impact, and they can be replaced with much more impactful initiatives.

Learn from failure and turn it into success. If you find your marketing budget is too small, maybe it is … but maybe it can go farther if it’s allocated differently.

If you’re thinking of empowering your front line staff by giving them the authority to allocate a small portion of your marketing funds, have them view it as a monthly budget, rather than an annual amount because smaller budget amounts are easier to manage for team members who never had to work with a budget before.

“There are hundreds of things in a budget,” Parvazi says. “The key to successful allocation is tracking and reviewing on an ongoing basis so that you know every dollar is strategically allocated for maximum impact.”